Buyer Closing Costs: ~1.5-2.5% of Sales price

The closing is the culmination of your home-buying journey — it’s when the parties come together to legally transfer ownership of the property to you, in exchange for your payment of the purchase price to Seller.

[Video: Homebuyer 101: What to Expect on Closing Day](https://tgre.notion.site/Video-Homebuyer-101-What-to-Expect-on-Closing-Day-d56a258094184d6982166fa237b7c241)

The closing is the final step in the home-buying process and is when you become the new owner of the property.

At the closing, all funds necessary to complete the purchase of the property are gathered together from you and the lender and then distributed to the appropriate parties: the Seller receives the purchase price; the attorneys receive their legal fees; the real estate agents receive their commissions; the title company receives their fees and the title insurance premiums; the county receives recording fees; and so on.

There are actually two parts to the closing:

The Loan Closing happens first and is attended by you, your attorney, optionally your real estate agent, and the settlement agent for the transaction. During the Loan Closing, you’ll sign the Closing Disclosure and all of the documents in the loan package that was prepared for you by the lender, including the Promissory Note and the Mortgage. The lender will then officially release the loan funds to the settlement agent so that those funds can be used to pay for the property during the subsequent Title Closing. The Loan Closing takes, on average, anywhere from 30-60 minutes.

The Title Closing begins as soon as the Loan Closing is complete and is when ownership of the property is legally transferred from the Seller to you. Generally, the Seller’s attorney arrives at the closing to take a seat at the table on the Seller’s behalf and deliver the legal documents required for the transfer of title to you (including the Deed), as well as the keys to the home. In return, the Seller’s attorney collects a check from the settlement agent for the Seller’s sale proceeds, to take back to the Seller. Compared to the Loan Closing, the Title Closing tends to be quick, lasting only 10-15 minutes on average.

Your closing will be scheduled for a specific date, time, and place. Unless you’re buying new construction, the closing takes place at the office of your (the Buyer’s) attorney or, sometimes, your real estate agent’s brokerage office.

You should plan to arrive a few minutes early to the closing, as oftentimes the attorneys for the parties and the settlement agent will have multiple closings scheduled for the same day, so it’s important that you don’t go over your allotted time slot.

Your attorney will let you know ahead of time exactly what you need to bring to the closing, but generally those items will be:

📜 Two forms of identification for each buyer: One must be a government-issued photo ID such as a driver’s license or passport, while the other doesn’t have to include a photo, such as a student ID, voter registration card, banking card, etc. Most commonly, though, buyers bring their license and passport; 💰 A bank check in the amount of your Cash-to-Close, made payable to the settlement agent (unless you’ve wired your Cash-to-Close to the settlement agent ahead of time); 💳 Your personal checkbook in case of any last-minute, minor adjustments to the Closing Disclosure or between the parties.

When you arrive at the closing, you’ll settle into your seats at the closing table and give your IDs and bank check to the settlement agent. (Your IDs will be photocopied and then returned to you.)

Typically, the settlement agent or your attorney will kick off the closing by walking you through the Closing Disclosure in detail so you can understand all of your transaction costs. You’ll then sign the Closing Disclosure.

The settlement agent and your attorney will take you through the loan package received from the lender and have you sign the many documents therein. The two most important documents in the loan package are the Promissory Note and the Mortgage.

📝 The Promissory Note (or “Note”) is the legal document that evidences your indebtedness to the lender and your formal promise to repay the mortgage loan according to the terms you’ve agreed to — i.e., every month, at a specified interest rate, and for a specified loan term.

🏠 The Mortgage, on the other hand, is the security instrument that you give to the lender to protect the lender’s interest in your property. When you sign the Mortgage, you are pledging the property to the lender as collateral for the mortgage loan, giving the lender the right to take the property by foreclosure if you fail to repay the loan according to the terms you’ve agreed to.

💼 Additionally, the loan package will contain a number of affidavits and declarations for you to sign. Affidavits and declarations are statements declaring something to be true, like the fact that the property will be your principal place of residence, or that all the repairs needed on the property were completed prior to closing.

💡 QUICK TIP: Your first mortgage payment will be due on the 1st of the month following the month after the closing. This is because you pre-pay the interest for the remainder of the month of the closing at the closing itself, and then thereafter you pay your mortgage in arrears (meaning, “after the fact”). So if you’re closing on January 20th, at the closing you will pre-pay your mortgage interest for January 20th thru the end of the month, and then on March 1st you will make your first mortgage payment of principal plus the interest that accrued during the month of February.

After you’ve signed the loan package, some or all of the signed documents in the package may need to be electronically scanned to the lender for a quick quality control review by the lender, to confirm proper execution of the documents. Once the lender has confirmed proper execution, it will give the settlement agent authorization to disburse (or use) the loan funds for the “Title Closing” portion of the closing, which happens next. This authorization to utilize the loan funds to complete the purchase of the property is known as “Funding Authorization.” At this point, your loan is officially deemed “closed,” and you now have the money you need to complete your purchase of the property — i.e., to close title to the property.

The Title Closing is the second part of the closing and is when the Seller’s attorney — and oftentimes the Seller’s real estate agent too — joins you at the closing table to effectuate the transfer of ownership of the property from the Seller to you. This is accomplished via the Seller’s delivery of the Deed to you (via the Seller’s attorney), along with various other legally required documents and the keys to the property. Note that these days, sellers only very rarely attend the closing themselves.

📜 A Deed is a legal instrument by which title to property is transferred from one person or entity to another. In New Jersey, the standard form of Deed for residential transactions is a “Bargain and Sale Deed with Covenants Against Grantor’s Acts.” This type of Deed conveys to you whatever interest in the property the Seller has, and also contains additional promises (covenants) from the Seller that the Seller has not done anything to allow anyone to obtain any rights in the property. In addition, the Deed will name the Seller as the Grantor and you as the Grantee, will identify the property and sale price, and will be signed by the Seller. (Deeds are not signed by the Grantee/Buyer, since it is the Seller’s interest that is being transferred.)

👩💼 The settlement agent and your attorney will go over the Deed and other sale documents with you at the closing table and will provide you with copies. Immediately after the closing, the settlement agent will send both the original Deed and the Mortgage to the county clerk’s office to be recorded in the public record. (Recording puts the world on notice that you’re the owner of the property and protects you from future claims against your title.) After recording, the original Deed will be sent back to the settlement agent or your attorney, who will in turn mail it to you, while the original Mortgage will be sent to the lender.

The final step of the closing is the disbursement of all the money that’s been collected from you and your lender for the transaction, to the proper parties. In other words, this is when you pay the Seller for the property and pay everyone else involved in the transaction, thereby fulfilling your contractual obligations and completing the deal.

📑 The settlement agent handles the disbursement of all funds: the Seller receives the purchase price (minus the Seller’s closing costs, any credits given to you and any adjustments); the attorneys receive their legal fees; the real estate agents receive their commissions; the title company receives their search and settlement fees and the one-time premium payment for your and the lender’s title insurance policies; and so on.

🛋️ Now that you’ve received the Deed and keys and paid the Seller for the property and anyone else who provided you a service along the way, the closing is complete and you’re officially a new homeowner!

Move into your new home! You’ve made it to the end of the closing journey and are ready to begin a new chapter as a homeowner. CONGRATS!

📬 Within a few months of the closing, you’ll receive your owner’s title insurance policy and the original (now recorded) Deed. The speed with which you receive your title policy and recorded Deed in the mail after the closing largely depends on how busy the county clerk’s office and title company are around the time of your closing. During busy times of the year (such as spring and summer), there are long queues at both places, and it can take up to a few months to get those documents in the mail.

Now that you've completed the closing and have the keys to your new home, there are a few important steps to take to ensure a smooth transition and make the most of your new property.

🔑 1. Change the Locks: For added security, consider changing the locks on all exterior doors. You never know who might have keys to the previous locks, so getting new ones will give you peace of mind.

📋 2. Organize Important Documents: Keep all your closing documents, including the Deed, title insurance policy, and loan documents, in a safe place. Create a home file system to organize important paperwork related to your home, such as warranties, appliance manuals, and maintenance records.

💡 3. Set Up Utilities and Services: Make arrangements to have utilities transferred to your name, including electricity, gas, water, and trash services. Also, set up internet, cable, and any other essential services you may need.

🏠 4. Inspect and Clean Your Home: Conduct a thorough inspection of your new home to identify any potential issues that may need attention. Check for leaks, faulty electrical outlets, and any other repairs that might be necessary. Additionally, deep clean your home before moving in to start fresh.

🚪 5. Update Your Address: Notify the post office, government agencies, banks, insurance providers, and any other relevant parties of your new address. Don't forget to update your address on your driver's license and voter registration.

💰 6. Plan for Property Taxes and Insurance: Understand when your property tax bills will be due and plan accordingly. Keep track of your homeowner's insurance renewal date and make timely payments to ensure continuous coverage.

🌳 7. Familiarize Yourself with the Neighborhood: Explore your new neighborhood and get to know the local amenities, nearby parks, schools, and healthcare facilities. This will help you settle into your new community more easily.

🔧 8. Home Maintenance and Upgrades: Create a maintenance schedule to take care of routine tasks like changing HVAC filters, cleaning gutters, and inspecting the roof. Consider any upgrades or renovations you might want to make in the future.

🏦 9. Stay on Top of Mortgage Payments: Make sure to stay current on your mortgage payments. Set up automatic payments or reminders to avoid missing due dates.

🏡 10. Join Local Online Groups: Join local community groups or social media platforms where you can connect with neighbors and learn about events and activities in your area.

🏢 11. Plan for Future Financial Goals: Owning a home is a long-term commitment. Develop a financial plan that considers your future goals, such as paying off your mortgage early or saving for other significant milestones.

🌿 12. Enjoy Your New Home: Take the time to settle in and enjoy your new space. Host a housewarming party, invite friends and family over, and make lasting memories in your new home.

Remember, becoming a homeowner is an exciting and significant achievement. Taking these post-closing steps will help ensure a positive and fulfilling homeownership experience in New Jersey.

Video: New Homeowners: What to Expect After Your Purchase

Video: The Home Buying Trap: How New Debt Can Hurt Your Refinancing Options

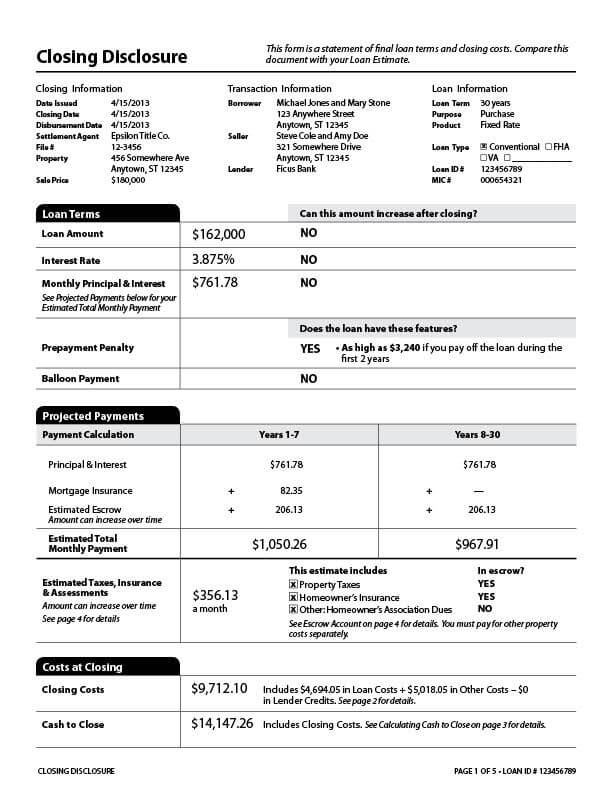

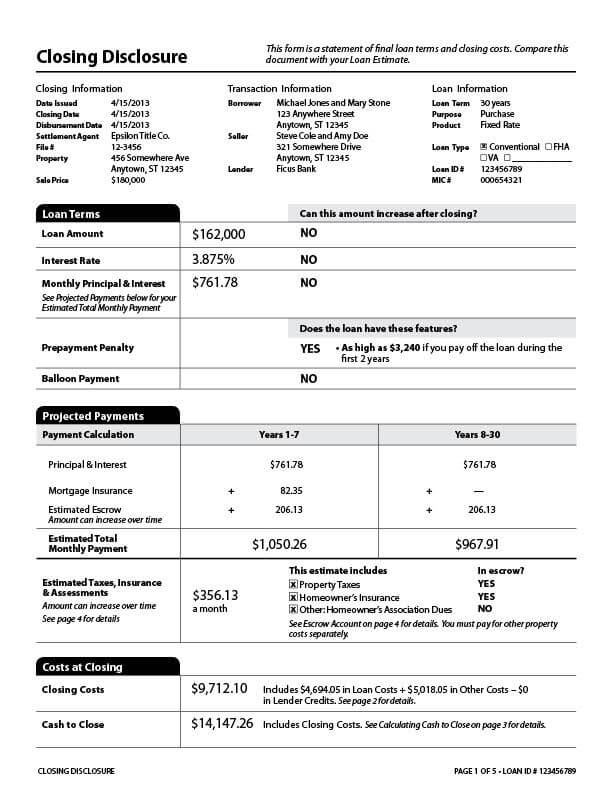

At least three days before your closing, you should receive a Closing Disclosure, which is a five-page document that gives you more details about your loan, its key terms, and how much you are paying in fees and other costs to get your mortgage and buy your home.

Many of the costs you pay at closing are set by the decisions you made when you were shopping for a mortgage. Charges shown under “services you can shop for” may increase at closing, but generally by no more than 10 percent of the costs listed on your final Loan Estimate.

Page 1: Information, loan terms, projected payments costs at closing

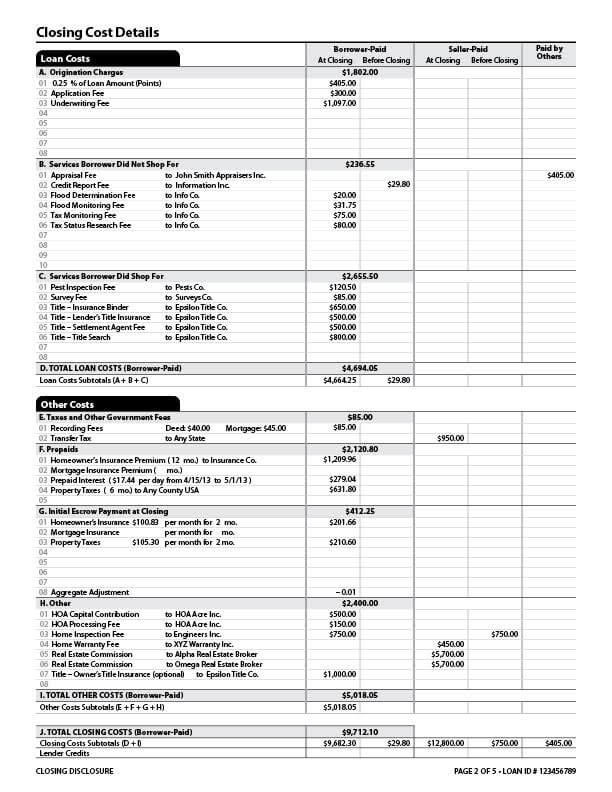

Page 2: Closing cost details including loan costs and other costs

Loan and other cost details paper

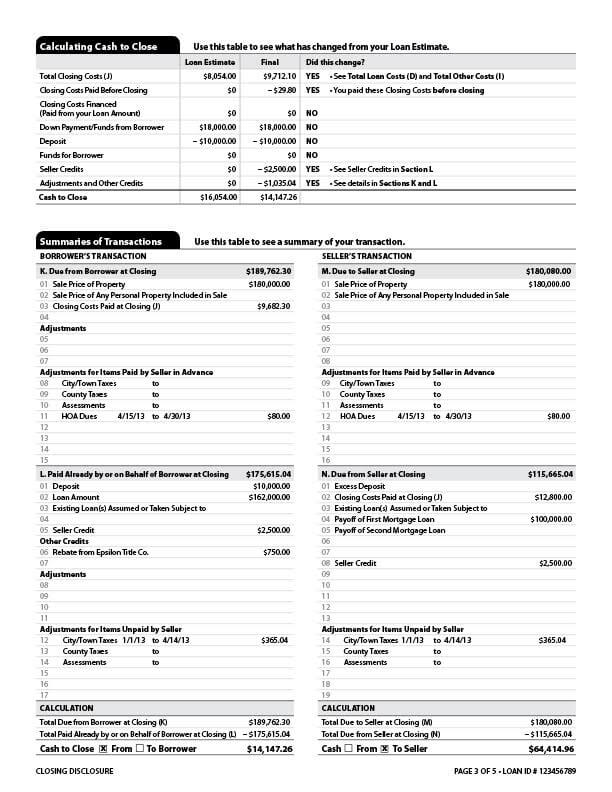

Page 3: Cash needed to close and a summary of the transaction

Summaries of transactions

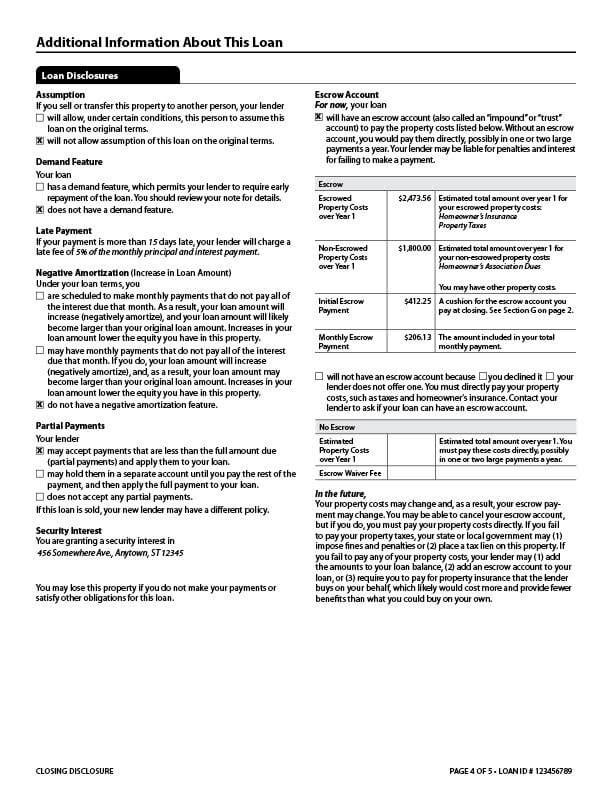

Page 4: Additional information about your loan

Real Estate Loan disclosure paper

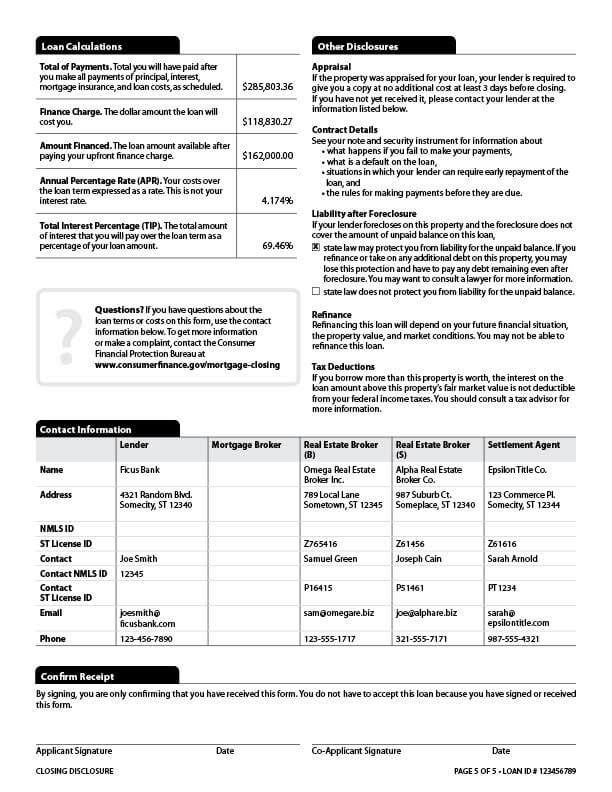

Page 5: Loan calculations, disclosure information and contact information

Real Estate Loan Calculations and other disclosures

https://api.leadconnectorhq.com/widget/group/I4irR3ojzj6Scx0N7A8K