With increasing inflation and the cost of living, more Americans are questioning if it’s worth staying in their home state when they could save thousands on State Income Tax.

Whether you call it ‘moving domicile’ or ‘moving residency’, it’s typically with only one goal in mind: Saving State Taxes!

Currently, ten (10) states have an income tax rate of 7% or more. California leads the pack at 12.3%. Hawaii, New Jersey, New York, and Washington D.C have income tax rates of over 10%! Other states are trying to attract new residents and making significant shifts in tax policy. Arizona recently just announced a 2.5% flat income tax rate that goes into effect on January 1, 2023!

Then the questions start piling up. For Example:

If you’re considering making a move to save on state taxes, create a master spreadsheet with all of the possible taxes, cost of the move, savings in the cost of living, etc. Carefully determine if it makes sense on paper. Then, if does, get to work taking the steps to move your residency or domicile. It doesn’t happen overnight.

First, we need to know what’s out there when it comes to State Income Tax Rates.

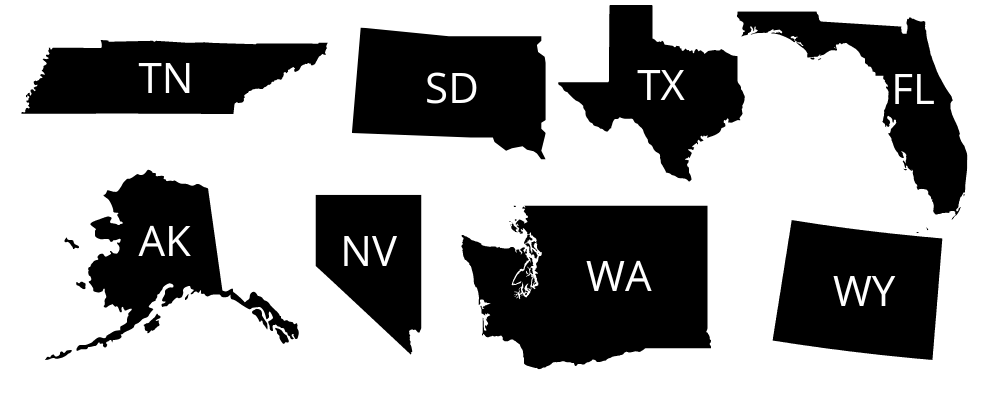

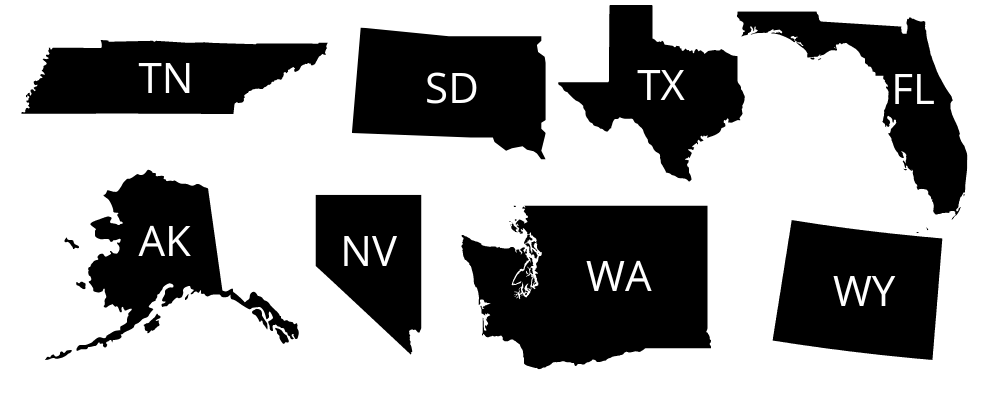

Tennessee, South Dakota, Texas, Florida, Alaska, Nevada, Washington, and Wyomning.

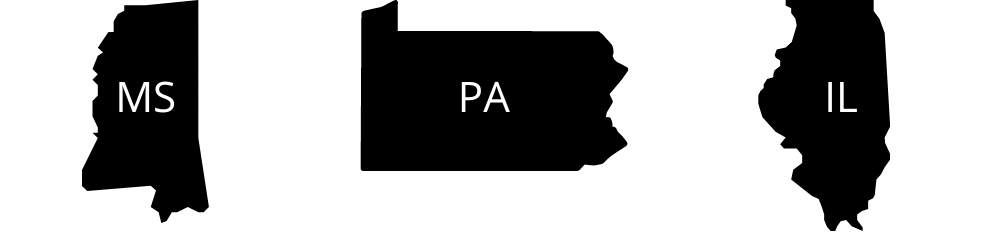

Missisippi, Pennsylvania, and Illinois.