Are you a self-employed or freelancer wanting to secure a mortgage without submitting traditional documentation to prove your income? Or do you have a high net worth and wish to keep it under wraps? A “No Doc” mortgage might be the solution you’re looking for. This type of mortgage allows borrowers to qualify without providing income verification documents, making it an attractive option for those with irregular income.

In this article, we’ll look at the 5 most popular No Doc loans, how they work, and whether they’re the right choice for you. So, whether you’re a business owner, investor, or simply looking for an alternative mortgage option, read on to find out if No Doc loans could be the key to owning your dream property.

No Doc Loans allows real estate investors and homebuyers to purchase or refinance a property without providing the usual documentation associated with traditional mortgages. Mortgage options falling under this category are often availed by business owners, self-employed individuals, realtors, freelancers, or anyone wanting to skip submitting pay stubs and W2s.

Also, these loans help borrowers skirt the long wait and exhaustive paperwork associated with FHA loans, Conventional loans, Freddie Mae, and Freddie Mac loans. No Doc Loans mortgage lenders often look for only recent bank statements and proof of repayment capability.

No document mortgages, also referred to as No Doc loans, are a type of mortgage loan where the lender does not require the borrower to provide any income or employment verification. Instead, the lender will rely solely on the borrower’s bank statements/ credit history, liquid assets, and real estate experience. These aspects are processed and verified through underwriting.

A No Document Loan program has fewer regulations and higher rates than conventional loans. The quick approval and flexibility provided to the borrower make it a convenient loan option for many no-income verification loan investors. Additionally, the No-Doc mortgage can be either fixed or adjustable, making it easier to plan the monthly mortgage payment strategy.

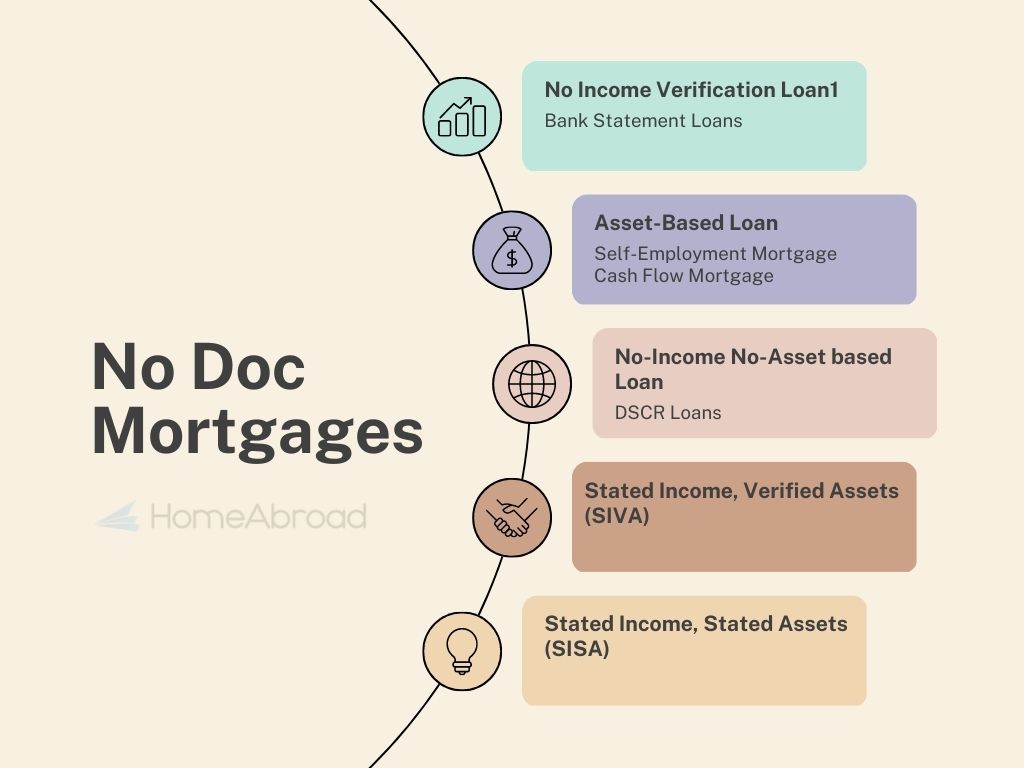

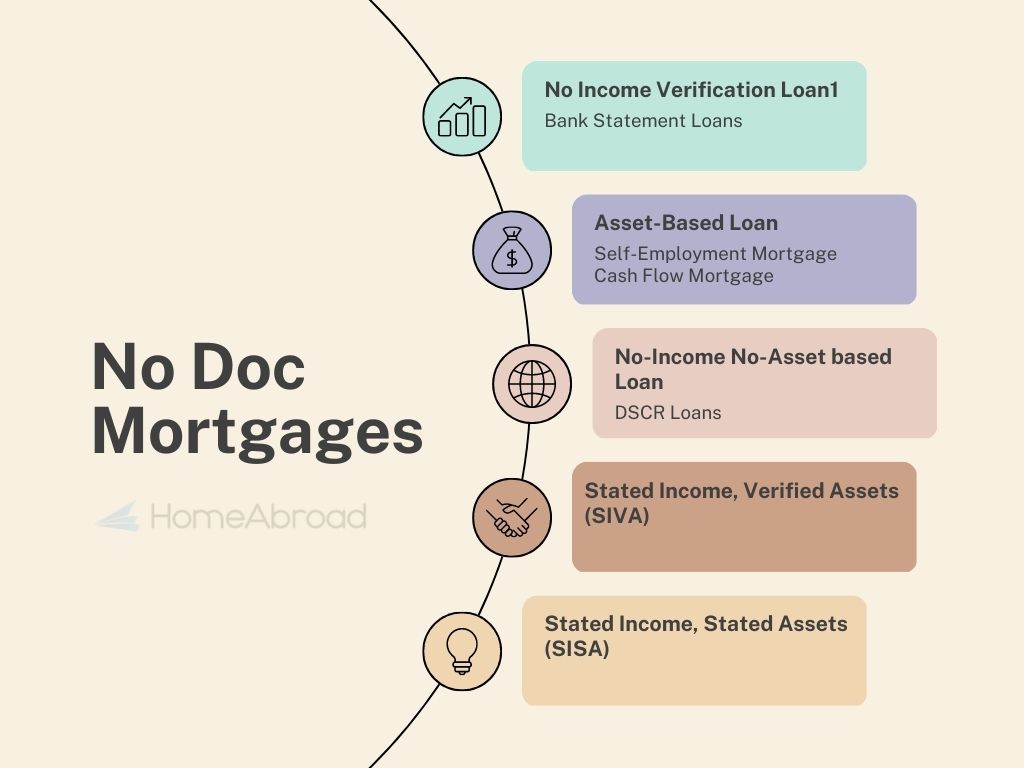

No documentation loans come in three types: No Income Verification (NIV), Asset-Based loans, No-Income No-Asset based loans, Stated Income, Stated Assets (SISA), and Stated Income, Verified Assets (SIVA). No Doc loans don’t require any proof of income, while No asset verification loans require the borrower to provide documents that show their assets are sufficient to cover the loan.

No Income Verification (NIV) No Doc loan approval is based on the borrower’s credit score and ability to repay the loan. No-income loans are easier to qualify for, but they typically have higher interest rates than loans that do require income verification. This loan option is great for home buyers.

No Income Verification Loan Option: